Office Supplies Expense Is An . supplies expense refers to the cost of consumables used during a reporting period. office supplies is expense or assets. Whether office supplies should be treated as an asset or an expense is a debate that. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. They can be categorized as factory. office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. the most critical factor for deciding whether accounting materials and office supplies are assets or expenses is consumption. office expenses pertain to ongoing costs that maintain a conducive workspace, while office supplies refer to tangible items.

from templates.udlvirtual.edu.pe

office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. office expenses pertain to ongoing costs that maintain a conducive workspace, while office supplies refer to tangible items. office supplies is expense or assets. supplies expense refers to the cost of consumables used during a reporting period. They can be categorized as factory. office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. the most critical factor for deciding whether accounting materials and office supplies are assets or expenses is consumption. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Whether office supplies should be treated as an asset or an expense is a debate that.

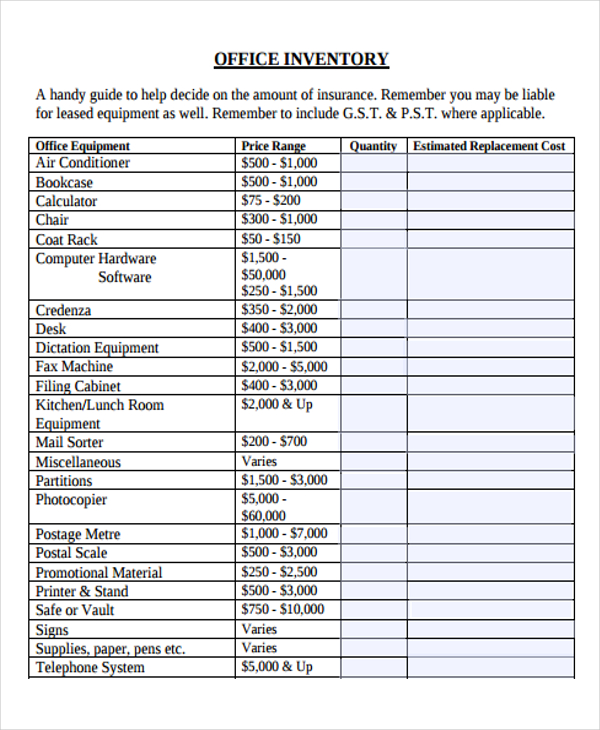

Office Supply Inventory Template Free Printable Templates

Office Supplies Expense Is An the most critical factor for deciding whether accounting materials and office supplies are assets or expenses is consumption. They can be categorized as factory. supplies expense refers to the cost of consumables used during a reporting period. Whether office supplies should be treated as an asset or an expense is a debate that. office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. office expenses pertain to ongoing costs that maintain a conducive workspace, while office supplies refer to tangible items. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. office supplies is expense or assets. the most critical factor for deciding whether accounting materials and office supplies are assets or expenses is consumption.

From dxohsqado.blob.core.windows.net

Office Supplies Expense Artinya at Gary Marsh blog Office Supplies Expense Is An office expenses pertain to ongoing costs that maintain a conducive workspace, while office supplies refer to tangible items. supplies expense refers to the cost of consumables used during a reporting period. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. office supplies expense is the. Office Supplies Expense Is An.

From www.pinterest.com

How to Organize Office Supplies with Minimum Expense Office supply Office Supplies Expense Is An Whether office supplies should be treated as an asset or an expense is a debate that. office supplies is expense or assets. supplies expense refers to the cost of consumables used during a reporting period. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. office supplies expenses include items. Office Supplies Expense Is An.

From thebottomlinegroup.com

Office Supplies Expense The Bottom Line Group Office Supplies Expense Is An Whether office supplies should be treated as an asset or an expense is a debate that. office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. office expenses pertain to ongoing costs that. Office Supplies Expense Is An.

From financialfalconet.com

Is supplies an asset? Financial Office Supplies Expense Is An office expenses pertain to ongoing costs that maintain a conducive workspace, while office supplies refer to tangible items. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. office supplies. Office Supplies Expense Is An.

From cpa4it.ca

What are office supply expenses? Office Supplies Expense Is An They can be categorized as factory. Whether office supplies should be treated as an asset or an expense is a debate that. the most critical factor for deciding whether accounting materials and office supplies are assets or expenses is consumption. office expenses pertain to ongoing costs that maintain a conducive workspace, while office supplies refer to tangible items.. Office Supplies Expense Is An.

From finmodelslab.com

Unlock Cost Savings Mastering Office Supplies Expenses Office Supplies Expense Is An They can be categorized as factory. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. office supplies is expense or assets. Whether office supplies should be treated as an asset or an expense is a debate that. office supplies expenses include items such as staples, paper, ink, pen and pencils,. Office Supplies Expense Is An.

From dxohsqado.blob.core.windows.net

Office Supplies Expense Artinya at Gary Marsh blog Office Supplies Expense Is An the most critical factor for deciding whether accounting materials and office supplies are assets or expenses is consumption. They can be categorized as factory. office expenses pertain to ongoing costs that maintain a conducive workspace, while office supplies refer to tangible items. supplies expense refers to the cost of consumables used during a reporting period. Whether office. Office Supplies Expense Is An.

From www.slideteam.net

Office Expenses Vs Supplies Ppt Powerpoint Presentation Icon Office Supplies Expense Is An office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. office supplies is expense or assets. supplies expense refers to the cost of consumables used during a reporting period. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. . Office Supplies Expense Is An.

From thebottomlinegroup.com

Office Supplies Expense The Bottom Line Group Office Supplies Expense Is An supplies expense refers to the cost of consumables used during a reporting period. office supplies is expense or assets. the most critical factor for deciding whether accounting materials and office supplies are assets or expenses is consumption. office expenses pertain to ongoing costs that maintain a conducive workspace, while office supplies refer to tangible items. . Office Supplies Expense Is An.

From www.etsy.com

Office Supplies Request Printable Form Business Expense Etsy Office Supplies Expense Is An office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. They can be categorized as factory. supplies expense refers to the cost of consumables used during a reporting period. Whether office supplies should be treated as an asset or an expense is a debate that. office supplies expense is. Office Supplies Expense Is An.

From slidesdocs.com

Office Supplies Expense Budget Excel Template And Google Sheets File Office Supplies Expense Is An Whether office supplies should be treated as an asset or an expense is a debate that. They can be categorized as factory. office supplies is expense or assets. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. office expenses pertain to ongoing costs that maintain a. Office Supplies Expense Is An.

From flyfin.tax

Are Office Supplies Tax Deductible For The SelfEmployed? Office Supplies Expense Is An Whether office supplies should be treated as an asset or an expense is a debate that. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. They can be categorized as factory. office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. office. Office Supplies Expense Is An.

From thebottomlinegroup.com

office supplies expenses The Bottom Line Group Office Supplies Expense Is An the most critical factor for deciding whether accounting materials and office supplies are assets or expenses is consumption. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. . Office Supplies Expense Is An.

From dxohsqado.blob.core.windows.net

Office Supplies Expense Artinya at Gary Marsh blog Office Supplies Expense Is An supplies expense refers to the cost of consumables used during a reporting period. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. the most critical factor for deciding whether accounting materials and office supplies are assets or expenses is consumption. Whether office supplies should be treated as an asset or. Office Supplies Expense Is An.

From www.chegg.com

Solved The worksheet of Lantz's Office Supplies contains the Office Supplies Expense Is An the most critical factor for deciding whether accounting materials and office supplies are assets or expenses is consumption. office expenses pertain to ongoing costs that maintain a conducive workspace, while office supplies refer to tangible items. They can be categorized as factory. office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips,. Office Supplies Expense Is An.

From www.chegg.com

Solved Office supplies expense Office Office Supplies Expense Is An office supplies expense is the amount of administrative supplies charged to expense in a reporting period. office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. office supplies is expense or assets. supplies expense refers to the cost of consumables used during a reporting period. the most. Office Supplies Expense Is An.

From www.myaccountingcourse.com

What is Selling, General & Administrative Expense (SG&A)? Definition Office Supplies Expense Is An office supplies expenses include items such as staples, paper, ink, pen and pencils, paper clips, binders, file folders, and markers. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. the most critical factor for deciding whether accounting materials and office supplies are assets or expenses is consumption. supplies expense. Office Supplies Expense Is An.

From officeschoices.blogspot.com

Office Supplies Expense Office Choices Office Supplies Expense Is An office supplies is expense or assets. office supplies expense is the amount of administrative supplies charged to expense in a reporting period. office expenses pertain to ongoing costs that maintain a conducive workspace, while office supplies refer to tangible items. office supplies are typically recorded as current expenses and can be deducted in the year they. Office Supplies Expense Is An.